March 2023

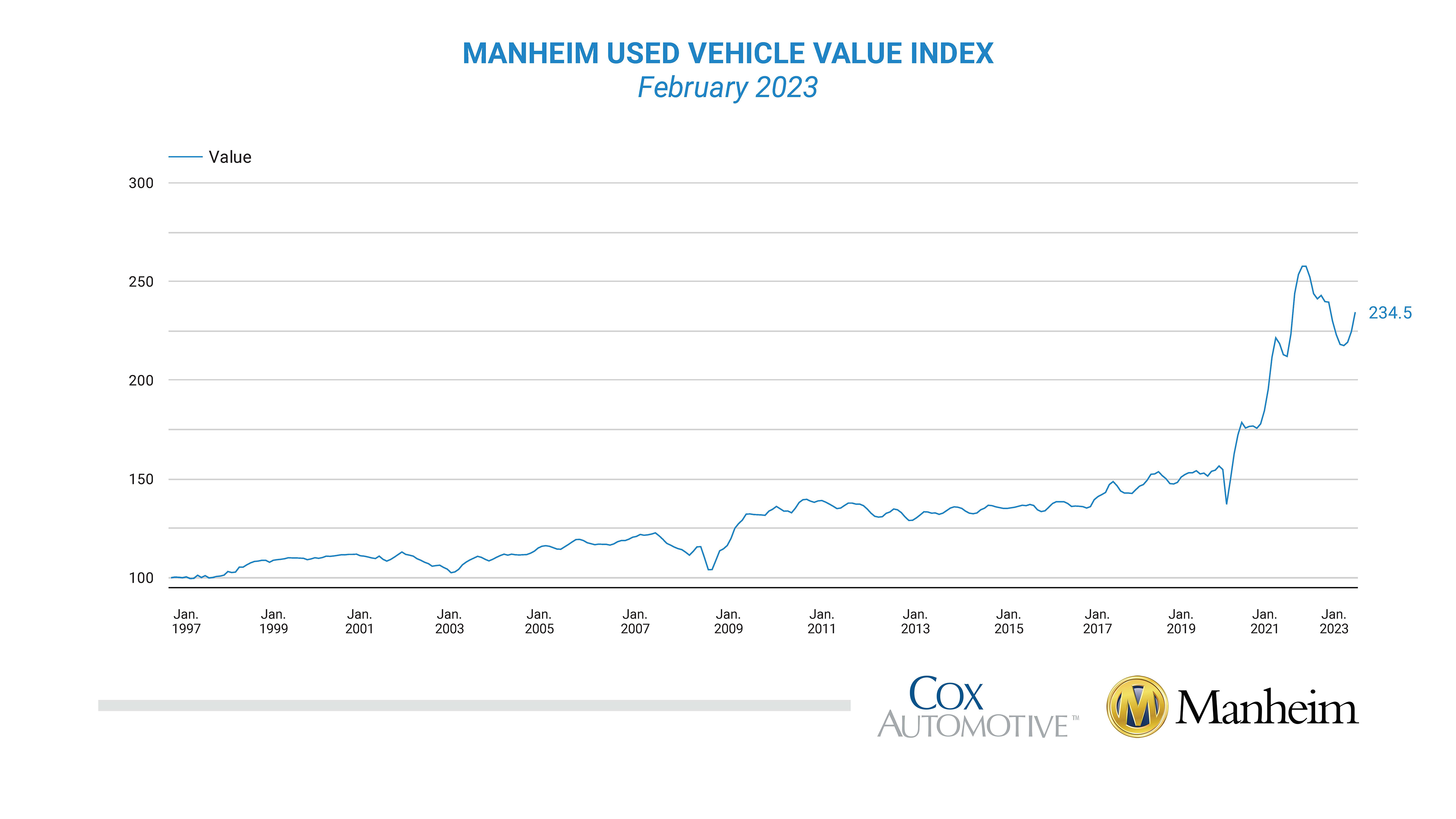

The Union Leasing remarketing team continues to monitor used vehicle trends in the marketplace. A hot year with limited new inventory and low interest driving sales, cooled off as interest rates rose. 2023 has opened similarly with inventory is available, but higher interest rates limiting buyer demand and softening pricing. From a broader perspective, although down 5.6% year over year in January, the used vehicle values remain well above pre-covid market of 2019. The pick up trucks continue to be in high demand with the smallest decline in in value, followed by compact cars, midsize cars, and vans. It is estimated that 2023 will continue to have strong resale values with a steady approach to pre-covid market.

With the Spring market ramping up, now is a great time of year to sell! After the recent market softening mentioned, pricing are ramping back up as shown in the chart below. Union has great partnerships in place to ensure effective lane efficiency, buyer base, and the right price.

Anna Stanke, Senior Manager Remarketing and Product Anna Stanke, Senior Manager Remarketing and Product

|

|

|

Fleets Cite Mounting Pressure to Contain Costs

With the current uncertainty about the overall direction of the national economy and the vitality of future market conditions in the latter half of this year and into calendar-year 2024, cost containment is the issue of the day.

Fleet managers are increasingly willing to recount the rising pressure they feel from management to examine how to contain or reduce fleet costs.

Fleet costs are necessary, but they’re substantial. Although varying by company, fleet costs typically fall in the top 10 corporate expenses; for some companies, fleet is one of the top five expense categories. As a result, fleet is often an initial places to which management looks to identify areas to control costs.

Click to Read More

|

|

Falling Lithium Prices Are Making Electric Cars More Affordable

Lithium, the common ingredient in almost all electric-car batteries, has become so precious that it is often called white gold. But something surprising has happened recently: The metal’s price has fallen, helping to make electric vehicles more affordable.

Since January, the price of lithium has dropped nearly 20 percent, according to Benchmark Minerals, even as sales of electric vehicles have soared. Cobalt, another important battery material, has fallen by more than half. Copper, essential to electric motors and batteries, has slipped about 18 percent, even though U.S. mines and copper-rich countries like Peru are struggling to increase production.

The sharp moves have confounded many analysts who predicted that prices would stay high, or even climb, slowing the transition to cleaner forms of transportation, an essential component of efforts to limit climate change.

Click here for full article

|

|

US Auto Industry Up 10% In 4th Quarter — But Down 16% Compared To Q4 2019

The US auto industry is truly on the rebound. In the 3rd quarter, sales increasing 1% compared to the 3rd quarter of 2021, the first positive trend in a while. But was it just a lucky little blip? Seemingly not, as US auto industry sales in the 4th quarter of 2022 were 10% higher than US auto industry sales in the 4th quarter of 2021.

So, the US auto industry is on the rise, but what about the details? Which brands are up, and which are down? Here’s a thorough Q4 vs. Q4 comparison going back through 2019. While you might find year-over-year comparisons of the US auto industry or even auto brands elsewhere, I don’t think you’ll find this level of comparison going back to pre-Covid times anywhere else on the internet. So, if you like this kind of thing, grab some popcorn, get comfy, and jump in below.

You can learn more here

|

|

|